CR Land Releases 2021 Annual Performance with Net Profits of RMB 32.4b

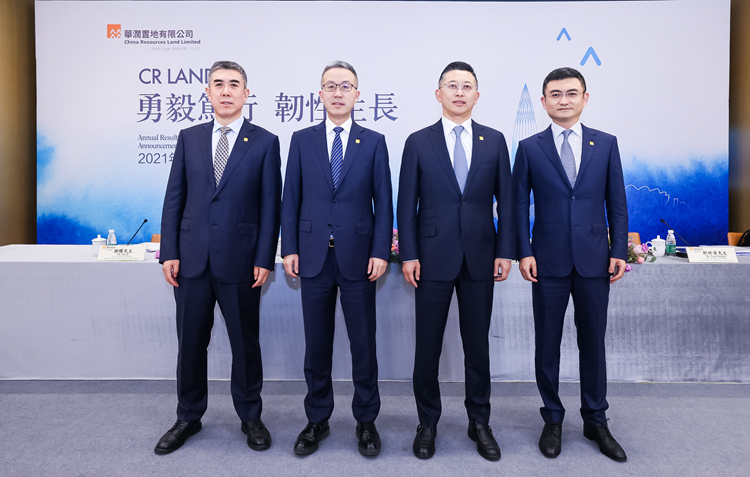

On March 31, CR Land held the 2021 Annual Performance Conference in Shenzhen. The conference was attended by Li Xin, Executive Director and President, Zhang Dawei, Executive Director and Chief Operating Officer, Xie Ji, Executive Director and Chief Strategy Officer, and Guo Shiqing, Executive Director and Chief Financial Officer of CR Land.

In 2021, all core performance indicators of CR Land achieved steady growth. Its consolidated turnover for the year was RMB 212.1 billion, an increase of 18.1% year on year; its net profit attributable to shareholders was RMB 32.4 billion, an year-on-year increase of 8.7%; its core net profit was RMB 26.6 billion, an increase of 10.2%. As of December 31, 2021, its net asset value per share reached RMB 31.8, an increase of 11.4% from that at the end of 2020. All core performance indicators continued to maintain steady growth in 2021, with the annual performance target reached, proving that it achieved high-quality development and sustainable growth.

Its development and sales business obtained a contract value of RMB 315.8 billion, an increase of 10.8% compared with 2020, which meant that its annual sales target was met. In terms of operational real estate business, its retail sales of shopping malls increased by 45% year-on-year to RMB 107.2 billion, and its rental income registered RMB 13.9 billion, with an annual increase of 38.1%, which was significantly higher than the market average. During the year 2021, CR Land continued to invest more in shopping malls, opened 9 shopping malls as scheduled, and won bids of 12 more shopping mall projects. By the end of 2021, CR Land had 54 MIXc series shopping malls in operation and about 61 reserve projects; 23 office buildings under its umbrella were in operation, with rental income increasing by 20% year-on-year to RMB 1.9 billion; the market influence of its own hotel brand "MUMIAN" increased year by year.

As a light asset management service platform under CR Land, CR MIXc Lifestyle has continued to build the "No. 1 Brand in China's Commercial Operation Management", with core indicators growing steadily. Its consolidated turnover for the year was RMB 8.9 billion, with a year-on-year increase of 30.9%, and the profit attributable to core shareholders was RMB 1.7 billion, with an increase of 108.5%. By the end of 2021, it had 71 shopping malls in operation, 115 office buildings in operation, a total contracted property management area of 196 million m2, and an area under management of 155 million m2.

In terms of ecosystem element business, CR Land is involved in multiple real estate derivative fields such as urban construction and operation, long-term rental, industry, health care and film. In terms of urban construction and operation, the company actively promoted the coordinated business expansion in the district. Recently, it won the bid to be the service provider for the early stage project of Shenzhen Huafu Sub-district Renovation with its service area covering an area of over 5.75 km2. It completed the construction of the main venue for Xi'an National Games and Paralympic Games, and guaranteed the success of multiple events for these Games. Besides, the company actively responded to the national affordable rental housing policy and developed long-term rental business. The brand influence of "Youtha Suites" continued to increase. In 2021, the long-term rental business realized a turnover of RMB 313 million, with 30 projects in operation containing 20,000 rooms and 16 reserve projects containing 32,500 rooms.

Under the background of the "two-concentration" policy, it followed a prudent investment strategy, focusing on four national strategic regions and first- and second-tier high-energy cities. By the end of 2021, the company had a total land reserve area of 68.73 million m2 with high-quality layout and structure, indicating it can meet the development needs in the next three years or more.

Facing the challenges of tightening credit policies and increasing financial pressure in the industry, the company followed a prudent financial management policy. In other words, it strengthened cash flow management, expanded financing channels, increased financing reserves, continued to optimize financial structure, and enhanced financial flexibility. As a result, it had the lowest debt ratio and financing costs in the industry. During the year, S&P, Moody and Fitch continued to maintain CR Land's credit ratings of "BBB+/Stable Outlook","Baa1/Stable Outlook" and "BBB+/Stable Outlook", respectively.

CR Land is committed to promoting the improvement of environmental, social and governance standards and achieving sustainable development. In 2021, it actively responded to the national 30·60 decarbonization strategy, set up a leading group for carbon peaking and carbon neutrality, and conducted research on the formulation and implementation of 30·60 goals; it continued to promote the national rural revitalization strategy, completed the construction of Yan'an Hope Town, and was also planning and building the Nanjiang Hope Town; it explored green financing and obtained ESG loans of about HK$ 2.7 billion. In addition, it was upgraded by MSCI to BBB in ESG rating, selected as a constituent stock of Hang Seng Corporate Sustainability Index, and included in the "State-owned Enterprises ESG Pioneer 50 Index" of the SASAC. In addition, it was recognized by the SASAC as a model enterprise for corporate governance of central SOEs (ordinary enterprises).

In 2022, CR Land will take the following actions for better development: actively cope with challenges in the industry and seize opportunities, follow the principle of guiding investment by strategies and living within our means, continue to deeply explore first- and second-tier high-energy cities, and improve the quality of investment; optimize the refined management of production and operation, and improve the full-cycle return capability and market competitiveness of the projects; stimulate organizational vitality and innovation vitality, achieve stable growth of its performance and continuous improvement in shareholder value.